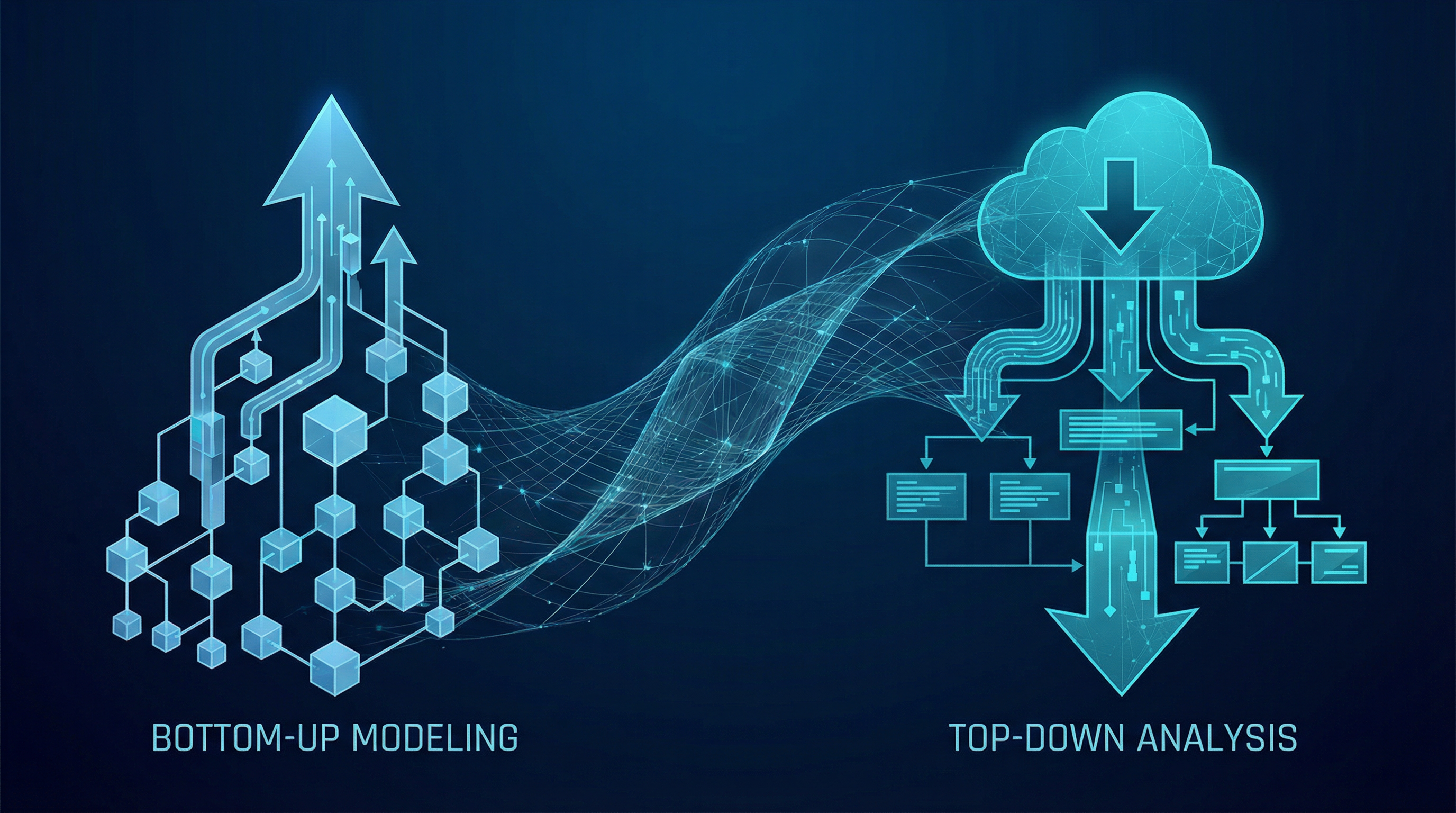

Bottom-up and top-down approaches constitute the two fundamental paradigms of financial and strategic modelling. Though often presented as opposing methodologies, they are in practice complementary: robust analysis requires both approaches, with reconciliation between them providing essential validation of assumptions and conclusions.

This article examines the theoretical foundations, practical implementation, and appropriate applications of each approach, drawing on EXXING's experience across more than fifty financial modelling engagements in European and African TMT markets.

Conceptual Foundations

Bottom-Up Approach

The bottom-up approach constructs forecasts from elementary units (products, customers, sites, transactions) and aggregates upward to derive totals.

Fundamental Logic: Sum of parts = Total

Revenue_total = Σ Revenue_unit_i (for all units i = 1 to n)

The approach mirrors how businesses actually operate: individual customers make purchasing decisions, individual products generate revenues, individual assets incur costs. Bottom-up models capture this operational reality.

TMT Example: Forecasting mobile operator revenue by:

- Projecting subscribers by segment (prepaid, postpaid, enterprise)

- Estimating ARPU by product (voice, data, messaging, value-added services)

- Calculating revenue by segment-product combination

- Aggregating to total revenue

Top-Down Approach

The top-down approach constructs forecasts from market totals and allocates downward based on market shares or other distribution keys.

Fundamental Logic: Total × Share = Unit

Revenue_company = Market_total × Market_share

The approach reflects how markets function: total demand exists independently of any individual supplier, and companies compete for shares of that demand.

TMT Example: Forecasting mobile operator revenue by:

- Estimating total addressable market (population × penetration × ARPU)

- Projecting market share evolution based on competitive dynamics

- Calculating company revenue as market × share

Comparative Analysis

| Criterion | Bottom-Up | Top-Down |

|---|---|---|

| Starting point | Operational units (products, customers, assets) | Total market, macroeconomic drivers |

| Granularity | Highly detailed (hundreds of line items) | Aggregated (tens of line items) |

| Data requirements | Internal data (CRM, billing, operations) | External data (market research, regulatory filings) |

| Model complexity | High (complex interdependencies) | Low (straightforward calculations) |

| Short-term accuracy | High (1-2 years) | Moderate |

| Long-term accuracy | Moderate (3-5 years) | High |

| Typical bias | Operational optimism | Market share underestimation |

| Primary use cases | Budgeting, business planning, operational decisions | Strategy, due diligence, market sizing |

The complementary nature of these approaches becomes apparent when considering their respective strengths and weaknesses. Bottom-up models excel at capturing operational detail but may miss market-level constraints; top-down models capture market dynamics but may miss operational realities.

Bottom-Up Methodology

Step One: Segmentation

Effective bottom-up modelling requires thoughtful segmentation that balances granularity with practicality. Segments should be:

- Homogeneous: Units within a segment behave similarly

- Measurable: Data exists to quantify segment characteristics

- Substantial: Segments are large enough to matter

- Actionable: Segments correspond to business decisions

TMT Segmentation Dimensions:

| Sector | Primary Dimensions | Secondary Dimensions |

|---|---|---|

| Mobile telecommunications | Customer type (B2C/B2B), contract type (prepaid/postpaid) | Technology (4G/5G), geography, product |

| Fixed broadband | Customer type, technology (fibre/copper/cable) | Speed tier, bundle composition |

| Data centres | Facility type (retail/wholesale/hyperscale), geography | Power tier, contract duration |

| Tower infrastructure | Tenant type (MNO/MVNO/other), geography | Tower type (ground/rooftop), tenancy |

Step Two: Driver Identification

Each segment requires identification of the key drivers that determine revenue and cost outcomes. The driver tree decomposes aggregate metrics into their constituent elements.

Example: Mobile B2C Revenue

| Level | Driver | Formula |

|---|---|---|

| 1 | Total revenue | Subscribers × ARPU |

| 2 | Subscribers | Opening base + Gross adds - Churn |

| 3 | Gross adds | Market growth + Competitor switching + New-to-mobile |

| 4 | Churn | Voluntary churn + Involuntary churn |

| 5 | ARPU | Voice revenue + Data revenue + Messaging + VAS |

| 6 | Data revenue | Data users × Data ARPU |

| 7 | Data ARPU | GB consumed × Price per GB |

This decomposition enables granular forecasting whilst maintaining logical consistency. Changes in any driver flow through to aggregate outcomes.

Step Three: Driver Projection

Each driver requires a projection methodology appropriate to its characteristics:

| Driver Type | Projection Method | Example |

|---|---|---|

| Trend-driven | Historical extrapolation with adjustment | Data consumption growth |

| Capacity-constrained | Saturation curves (logistic, Gompertz) | Subscriber penetration |

| Price-driven | Elasticity models | ARPU response to price changes |

| Event-driven | Scenario analysis | Spectrum auction outcomes |

| Policy-driven | Regulatory analysis | Termination rate glide paths |

Case Study: Nigerian Mobile Operator

EXXING developed a bottom-up model for a Nigerian mobile operator with the following driver structure:

| Driver | Historical | Projection Basis | Forecast |

|---|---|---|---|

| Population (millions) | 218 | UN projections | 230 (2028) |

| Mobile penetration | 87% | Saturation curve | 95% (2028) |

| Operator market share | 38% | Competitive analysis | 36% (2028) |

| Subscribers (millions) | 72 | Calculated | 79 (2028) |

| Voice ARPU (₦) | 850 | -5% CAGR (substitution) | 680 (2028) |

| Data ARPU (₦) | 1,200 | +8% CAGR (usage growth) | 1,760 (2028) |

| Blended ARPU (₦) | 2,050 | Calculated | 2,440 (2028) |

| Revenue (₦ billions) | 148 | Calculated | 193 (2028) |

Step Four: Aggregation and Validation

Bottom-up models aggregate unit-level projections to derive totals. Critical validation checks include:

- Internal consistency: Do segment totals equal company totals?

- Capacity constraints: Do projections exceed physical or market limits?

- Historical patterns: Are growth rates consistent with historical experience?

- Competitive logic: Do market share assumptions sum to 100%?

Top-Down Methodology

Step One: Market Definition

Top-down analysis begins with precise market definition. The Total Addressable Market (TAM) represents the maximum revenue opportunity if the company captured 100% share.

Market Definition Framework:

| Level | Definition | Example (African Data Centres) |

|---|---|---|

| TAM | Total potential market | All enterprise IT spending in Africa |

| SAM | Serviceable addressable market | Outsourced data centre spending |

| SOM | Serviceable obtainable market | Data centre spending in target countries |

Market Sizing Methods:

| Method | Approach | Appropriate When |

|---|---|---|

| Demand-side | Population × Adoption × Spend | Consumer markets with demographic data |

| Supply-side | Sum of competitor revenues | Markets with public company data |

| Proxy | Comparable market × Adjustment | Emerging markets with limited data |

| Build-up | Sum of identified customer budgets | B2B markets with known customers |

Step Two: Market Growth Projection

Market growth projections typically rely on:

- Macroeconomic drivers: GDP growth, population growth, urbanisation

- Technology adoption curves: S-curves for new technologies

- Regulatory factors: Liberalisation, spectrum availability

- Competitive dynamics: Entry, exit, consolidation

Case Study: West African Fibre Market

EXXING estimated the West African enterprise fibre market using multiple approaches:

| Method | Estimate (2028) | Basis |

|---|---|---|

| Demand-side | $850 million | Enterprises × IT spend × Connectivity share |

| Supply-side | $780 million | Current market + Growth rate |

| Proxy (South Africa) | $920 million | SA market × GDP ratio × Adjustment |

| Triangulated estimate | $850 million | Weighted average |

Step Three: Market Share Analysis

Market share projections require analysis of:

- Current positioning: Existing share, trend direction

- Competitive advantages: Network coverage, brand, distribution

- Strategic initiatives: Investment plans, product launches

- Competitive responses: Likely reactions from rivals

Porter's Five Forces provides a useful framework for assessing competitive dynamics that influence market share evolution [1].

Step Four: Revenue Calculation

Top-down revenue calculation follows directly:

Company Revenue = Market Size × Market Share

The simplicity of this calculation belies the analytical work required to estimate market size and share credibly.

Reconciliation: The Critical Step

The most valuable insight often emerges from reconciling bottom-up and top-down analyses. Discrepancies indicate either:

- Errors in one or both approaches

- Unrealistic assumptions requiring revision

- Strategic insights about market positioning

Reconciliation Process:

| Step | Action | Outcome |

|---|---|---|

| 1 | Compare totals | Identify magnitude of discrepancy |

| 2 | Decompose difference | Attribute to specific drivers |

| 3 | Validate assumptions | Test reasonableness of each approach |

| 4 | Iterate | Revise assumptions until convergence |

| 5 | Document | Record reconciliation logic |

Case Study: Reconciliation Gap

For a Moroccan telecommunications operator, initial models showed:

| Approach | 2028 Revenue Forecast |

|---|---|

| Bottom-up | MAD 18.2 billion |

| Top-down | MAD 15.8 billion |

| Gap | MAD 2.4 billion (15%) |

Root Cause Analysis:

- Bottom-up assumed 3% annual ARPU growth; market data suggested flat ARPU

- Top-down assumed market share decline; operational data showed share stability

- Reconciled forecast: MAD 16.8 billion (bottom-up ARPU revised, top-down share revised)

The reconciliation process revealed that management's ARPU assumptions were optimistic relative to market trends, whilst external analysts underestimated the operator's competitive position.

Application Guidelines

When to Emphasise Bottom-Up

| Situation | Rationale |

|---|---|

| Short-term forecasting (1-2 years) | Operational detail drives near-term outcomes |

| Budgeting and planning | Accountability requires granular targets |

| Operational decisions | Actions affect specific drivers |

| Mature, stable markets | Historical patterns are reliable guides |

When to Emphasise Top-Down

| Situation | Rationale |

|---|---|

| Long-term forecasting (5+ years) | Market dynamics dominate operational detail |

| Strategic planning | Market positioning drives long-term value |

| Due diligence | External validation of management projections |

| New markets or products | Limited operational history |

Best Practice: Integrated Approach

EXXING recommends an integrated approach that:

- Develops both bottom-up and top-down models independently

- Reconciles discrepancies through structured analysis

- Uses reconciliation insights to refine assumptions

- Presents results with explicit acknowledgement of uncertainty

Conclusion

Bottom-up and top-down modelling approaches offer complementary perspectives on business performance and market dynamics. Neither approach alone provides complete insight; robust analysis requires both, with reconciliation between them serving as a powerful validation mechanism.

For TMT analysis specifically:

- Bottom-up captures the operational complexity of subscriber economics, network costs, and product mix

- Top-down captures market-level dynamics of penetration, competition, and technology adoption

- Reconciliation reveals assumption errors and strategic insights

EXXING's modelling practice combines both approaches across all engagements, ensuring that financial projections reflect both operational reality and market context.

Need robust financial modelling?

EXXING's financial modelling practice delivers integrated bottom-up and top-down analyses for valuation, strategic planning, and investment decisions across TMT sectors.

Schedule a consultation | Explore our methodologies

References

[1] Porter, M.E. (1980). Competitive Strategy: Techniques for Analyzing Industries and Competitors. Free Press.

[2] Damodaran, A. (2012). Investment Valuation: Tools and Techniques for Determining the Value of Any Asset (3rd ed.). Wiley.

[3] Koller, T., Goedhart, M., & Wessels, D. (2020). Valuation: Measuring and Managing the Value of Companies (7th ed.). McKinsey & Company, Wiley.

[4] Benninga, S. (2014). Financial Modeling (4th ed.). MIT Press.

[5] GSMA (2023). The Mobile Economy. GSM Association. [Industry data source for telecommunications market sizing]